It's fairly easy to spot pain points and un-addressed needs that customers have. But I've seen product teams spend huge amounts effort on addressing "pain points" that don't matter that much to customers or don't fit a business's unique situation at that time.

For this reason it's critically important for product teams to develop a view of the relative importance of addressing opportunities that they've identified.

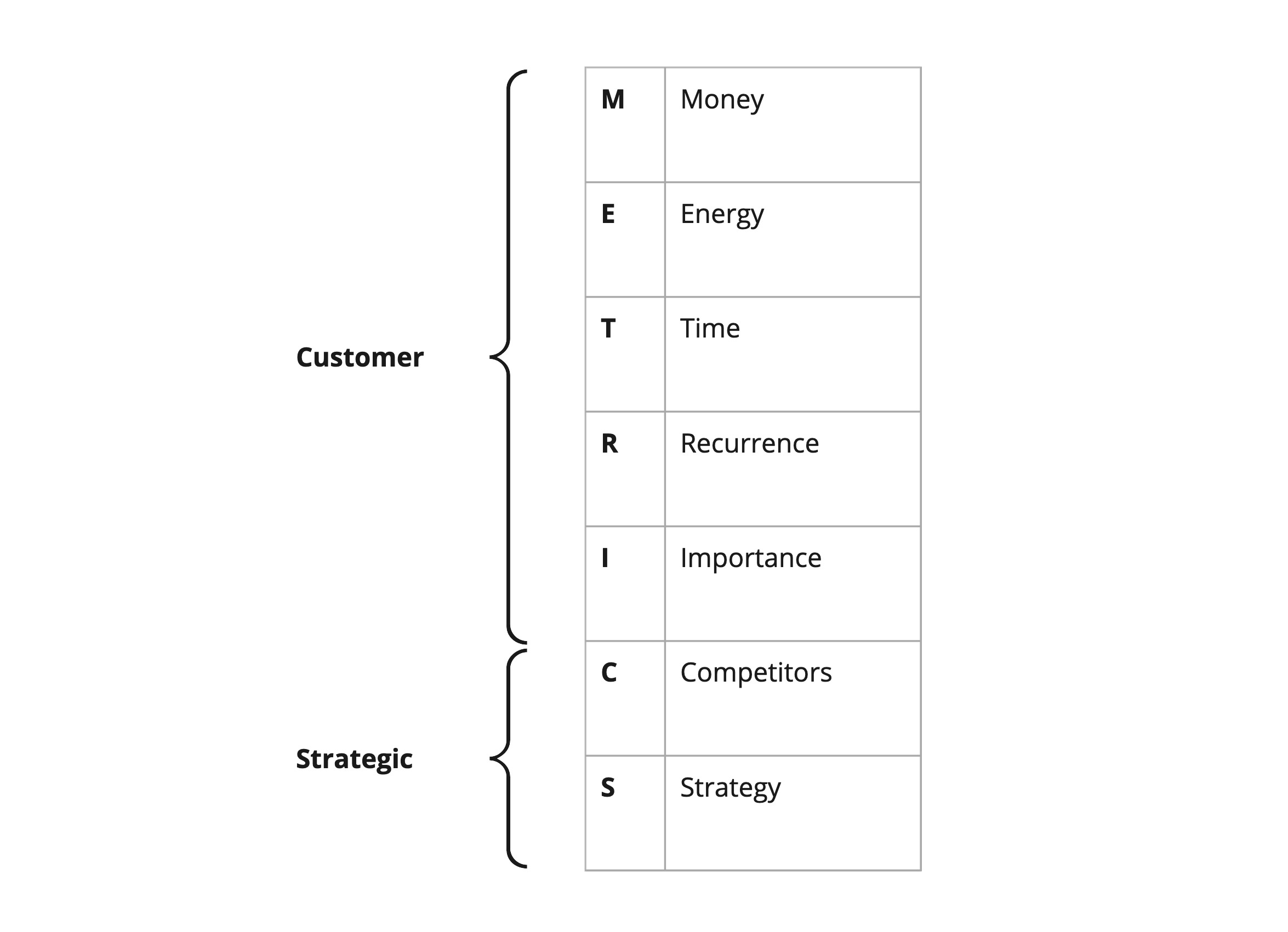

In this article I'll outline a framework for prioritising opportunities level that I call the METRICS model. Using this handy mnemonic, I'll explain to you use (a) customer factors and (b) strategy factors to prioritise opportunities - and (c) how to engage your team to reach a prioritisation decision.

Customer Factors - METRI

Generative research, customer support issues, sales/marketing team feedback and analytics are all great sources you can use to identify opportunities to help your customers. Here I'll outline 5 sets of questions your team can ask itself to prioritise them. They fall under the following categories:

- Money

- Energy

- Time

- Recurrence

- Importance

Money

For products to be commercially successful they need to do more than just solve a problem - they need to solve a problem customers are willing to pay to solve at a level that's commercially viable for your organisation. Therefore, probing into willingness to pay can give you clues into the value of working on certain opportunities.

Questions:

- How much money are customers spending to solve this problem currently?

- What have they spent on it in the past?

- What impact would solving this problem have on their personal financial situation?

In a B2B context, get clear on the difference between the impact on an individual's finances (e.g. any bonus / commission) vs. the company's finances as these aren't always aligned.

Energy

A good sign you've spotted a customer need that is valuable to work on is finding customers who have put effort and energy into building their own solution due to (a) the need being pressing and (b) a solution not being available.

Questions:

- Are people putting significant energy into finding or creating a solution?

- Have they 'hacked' together a solution themselves?

- How do they talk about this need? Do you detect a strong emotional reaction to this need?

Time

People often use the fast, intuitive part of their brain when asked about their use of products - rather than the rational, quantitative part of their brain. When opportunities around time-saving arise, try to dig past phrases like "ages" and "slow" to turn them into estimates of minutes/hours/days spent (preferably backed up by metrics).

Questions

- How much time is a customer actively spending accomplishing a goal?

- How much time is a customer waiting in a process to accomplishing a goal?

Recurrence

To maximise your impact, it's important to check not just how strong a need is in a particular situation - but how often that situation occurs, and how many customers it applies to. Establishing actual recurrence helps you avoid succumbing to 'fre-cency bias' - where feedback heard frequently and recently disproportionately impacts decision-making.

Questions:

- How often does this need occur per customer?

- How many customers does this affect?

Importance

In customer research it's common to ask leading questions and focus questioning on an area of particular importance to the researcher. This approach can lead teams to succumb to the 'Focusing Illusion', described by Shreyas Doshi as follows:

Nothing in business is as important as it actually is, while you are talking about it.

Left unchecked, researchers can fail to assess how important an opportunity is to a customer - mistakenly focusing only on areas elicited by their research.

Questions:

- What is the relative importance of this problem/need to your customers compared to other problems/needs they have in their wider life/work?

Strategy Factors - CS

Even if you've found an important opportunity from a customer perspective, this doesn't necessarily mean it's the strategically right opportunity to work on. Companies' unique situation and product strategies have a big impact on the opportunities they select to work. Here I'll outline 2 areas you should consider:

- Competitors

- Strategy

Competitors

No product exists in a vacuum. Every product is competing against an alternative, whether that's a linear competitor like another tech company; a 'legacy' solution... or even inaction. That's why it's important to consider how exploiting an opportunity helps create value versus the alternatives.

Questions:

- How might exploiting this opportunity affect your customers perception of your product vs. alternatives?

- Would exploiting this opportunity differentiate your product vs. competitors?

- Would exploiting this opportunity address a significant reason customers don't choose your product - or churn in favour of alternatives?

Strategy

Strong product organisations will have an articulation of their product vision and product strategy that articulates the context in which they expect product teams to operate. It's worth ensuring you assess opportunities for fit with this context and can clearly and concisely articulate this. Doing so will help ensure your team's work is viable (as it fits with the business) and has the added benefit of helping to build trust with execs and stakeholders.

Questions:

- To what extent does exploiting this customer opportunity fit with your product strategy?

- To what extent does exploiting this customer opportunity fit with your product vision?

Putting it to action

Step 1: Gather METRICS data

To put the model to work, first gather the relevant data that you have for each opportunity. If you don't have a clear data point, make a rough estimate using a 'back of the envelope' calculation. The data you have doesn't need to be perfect as you're looking here for the relative importance of the opportunities. This is best done as individual work, but it doesn't have to be the same person.

Step 2: Check strategic alignment

Assign someone in your team to review any product strategy and vision documents and write a short summary about why the opportunity aligns (or not)

e.g. "Helps differentiate vs. #1 competitor"

Step 3: Share back

Once you have your data points and estimates, run a session with your product team or discovery trio to ensure everyone has shared understanding of the data points.

Step 4: Make a prioritisation decision

Once the data has been shared within the team, it's time to make a prioritisation decision. The data gathered should help make this

Trying it out

I hope you've found the above interesting, thought provoking and useful. If you do decide to give it a try, please do contact me and let me know how it went!

And remember to consider:

- Money

- Energy

- Time

- Recurrence

- Importance

- Competitors

- Strategy

If you'd like to read more on this topic I'd really recommend my guide on how to use opportunity solution trees, Teresa Torres' blog and Alan Klement's book When Coffee and Kale Compete - both of which inspired this framework.